Tired of the same old client acquisition methods? It's time to embrace a revolutionary approach with our Advisor Lead Generation Pricing strategy. Say goodbye to outdated pricing models and hello to a steady flow of qualified leads. Our cutting-edge solution simplifies lead management, allowing you to focus on high-value prospects and significantly reduce acquisition costs. With our powerful GoHighLevel CRM Solution, you can deliver personalized financial guidance at scale, fostering long-term client loyalty. This innovative technology is designed to elevate your advisory services, attract a broader audience, and drive sustainable business growth—all while ensuring transparent pricing that satisfies both you and your clients.

Struggling with low lead generation and outdated pricing strategies? It’s time to revolutionize your digital financial advisory services. Our article uncovers modern pricing approaches designed to save you time and money, while boosting advisor lead generation. Discover new digital advisory pricing strategies that offer top-tier returns and streamline your operations. Access our free guide for exclusive insights into best value streaming pricing models tailored for today’s competitive market.

- Save Time & Money: Best Advisor Lead Generation Pricing

- Free Access: New Digital Advisory Pricing Strategies

- Top-Tier Returns: Revolutionize Your Financial Advisor Pricing

- Generate More Leads: Modern Pricing for Digital Advisors

- Best Value: Streamline Digital Financial Advisory Pricing

Save Time & Money: Best Advisor Lead Generation Pricing

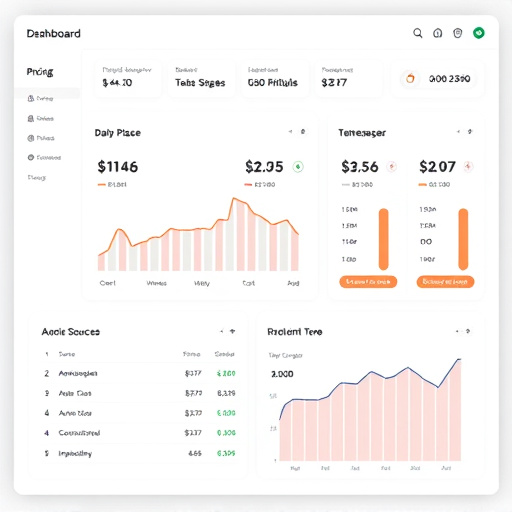

In today’s digital age, financial advisory services are evolving, and so are the methods to attract and retain clients. One of the most effective strategies is focusing on advisor lead generation pricing that saves both time and money. Utilizing a robust gohighlevel crm solution can streamline the process by efficiently managing client interactions and identifying high-quality leads. By implementing an advisor lead generation tool, financial advisors can quickly assess potential clients’ needs, offering them tailored solutions.

This approach not only reduces the cost of acquiring new customers but also enhances the overall customer experience. With a well-structured gohighlevel subscription pricing model, advisors can attract a steady stream of qualified prospects, ensuring long-term business growth and success.

Free Access: New Digital Advisory Pricing Strategies

In today’s digital age, the traditional models of financial advisory services are undergoing a significant transformation as free access becomes a key driver in shaping new pricing strategies. With the rise of robust and accessible online platforms, financial advisors now have the opportunity to attract a broader client base through innovative lead generation tactics. Gone are the days when charging an upfront fee was the primary method; instead, many digital advisory services are adopting subscription-based models or offering free initial consultations to capture interest and build trust with potential clients.

This shift towards free access has opened doors for both advisors and clients. On one hand, it allows gohighlevel financial advisor plans to experiment with diverse pricing structures, such as tiered subscriptions or performance-based fees. On the other hand, clients benefit from initial exposure to personalized advice without the commitment, enabling them to make informed decisions about their financial goals. The gohighlevel dashboard pricing and CRM solutions play a pivotal role in this new paradigm, providing advisors with efficient tools to manage client relationships and tailor their services accordingly.

Top-Tier Returns: Revolutionize Your Financial Advisor Pricing

In today’s digital era, the traditional financial advisory services landscape is undergoing a significant transformation as top-tier returns become the new norm. Gone are the days when simple hourly rates or fixed fees dominated the advisor lead generation pricing strategy. Modern clients demand more dynamic and flexible pricing models that align with their complex financial needs. The shift towards a revenue-sharing model, for instance, enables advisors to earn based on client performance, fostering long-term partnerships. This approach not only incentivizes advisors to help clients achieve their goals but also attracts high-net-worth individuals seeking innovative financial services pricing.

The gohighlevel dashboard pricing strategy is a prime example of revolutionizing advisor automation pricing. By leveraging technology and data analytics, advisors can now offer personalized investment strategies tailored to individual risk profiles. This not only enhances the client experience but also opens up opportunities for higher returns. The use of automated processes in financial services pricing models allows advisors to manage a larger portfolio while maintaining the same level of service quality, ultimately driving substantial growth in their businesses and ensuring they remain competitive in the market.

Generate More Leads: Modern Pricing for Digital Advisors

In today’s digital era, financial advisory services have evolved to cater to a broader audience through innovative online platforms. To generate more leads and attract potential clients, modern pricing approaches for digital advisors play a pivotal role. Instead of traditional fixed fees or hourly rates, many forward-thinking advisors are adopting flexible pricing models that align with the value they deliver. This shift enables them to target a wider range of customers, from young investors seeking guidance on retirement planning to entrepreneurs looking for strategic financial advice.

High-level marketing platforms and advisor client management systems have become essential tools in this new landscape. By leveraging these technologies, digital advisors can effectively communicate their unique value propositions, target specific demographics, and offer personalized services at scalable pricing points. This approach not only generates more leads but also fosters stronger relationships with clients by demonstrating a commitment to meeting individual financial needs efficiently and affordably.

Best Value: Streamline Digital Financial Advisory Pricing

In today’s digital age, streamlining and simplifying pricing models for financial advisory services is a game-changer. The traditional methods of charging hourly rates or annual fees are being challenged by innovative approaches that focus on delivering best value to clients. One such approach is leveraging advisor lead generation pricing strategies, which not only attract potential clients but also ensure a fair and transparent cost structure. This model allows financial advisors to invest more time in relationship-building and personalized advice, fostering long-term client loyalty.

By integrating advanced technologies like automation, advisors can optimize their processes, reduce administrative burdens, and offer tailored solutions using a high-level marketing platform. This enables them to develop go-highlevel financial advisor plans that cater to diverse client needs, resulting in increased efficiency and better outcomes. The key lies in balancing the art of personalized advisory with the science of automation, ensuring clients receive exceptional service while advisors maintain competitive pricing strategies.

Revolutionize your financial advisory business with our modern pricing strategies designed for digital advisors. Say goodbye to time-consuming lead generation and costly traditional pricing models. Our innovative approach ensures you offer the best value, attracting more clients and boosting top-tier returns. By adopting our streamlined pricing methods, you’ll not only save money but also generate a steady stream of high-quality leads, positioning your advisory services as an attractive, forward-thinking option in today’s digital era. Take the first step towards success by accessing our free guide on revolutionary advisor lead generation pricing and watch your business flourish!